Is Social Security a Ponzi Scheme?

There is something about the Social Security Administration that leads people to suspect that the SSA is a dishonest government scheme with the purpose to bilk the tax payer and social security beneficiary of their hard earned savings just at the moment in which they are retiring and trying to live on their SSA benefits and savings.

In the 1930's, following the Second World War, the Hearst Newspaper chain spread the rumor that social security contributors would be obliged to wear dog tags with their social security number stamped on them. The dog tag scheme really was proposed but it was never implemented.

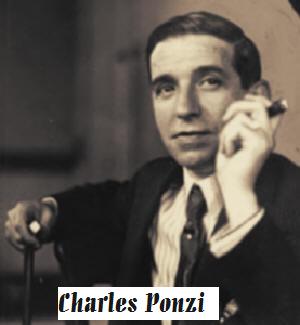

In the early 20th century, Charles Ponzi, a charismatic con artist and thief lured his “marks†into purchasing international postal coupons while promising a return on their investments of 50 percent per year at a time when banks were paying only 5% interest. Ponzi paid off early investors with receipts taken from later investors. Evidently, the scheme would work for only a short period of time before the demand by the investors for their 50% profits would demonstrate that there were not profits and that Ponzi had, in reality, made off with their investments.

Similar to the now-famous Ponzi scheme, participants in the Social Security system find that they are “making investments†in the Social Security system which only pays off after 40 to 60 years in the future. Unlike the Ponzi scheme, the Social Security Administration publishes very detailed information about its financial state in extremely exhaustive and detailed detail. In addition, the SSA publishes projections 75 years into the future based on different economic assumptions. On the other hand, unlike Ponzi schemes, the money that is not used to pay current benefits is invested by the SSA and has amassed a $2.6 trillion surplus.